Livestock Insurance Scheme

Today, let us talk about the Livestock Insurance Scheme and Policy claim Process.

This scheme has been implemented as a test between the years 2005 and 2008. This is implemented as a part of the tenth five-year plan in the year 2005 and as a part of the eleventh five-year plan in the year 2007. Approximately 100 districts were selected to check this scheme. The livestock which give very high yield and also which are crossbred are selected and insured. This insurance is done to the maximum of their price in the present market. The premium is up to 50%. The central government decided to bear the complete cost of the subsidy. This benefit will be provided to 2 animals for each beneficiary and for a time span of three years. Leaving Goa, this scheme has been implemented in all the states. This is done by the State Livestock development Board of the states. The executive boards also have plans to extend the scheme to another 100 districts which have already received subsidies during the test phase of the scheme. This also included a number of animals with different species.

Objectives of the scheme:

- To protect the farmers and the people who rear the livestock from any kind of loss that occurs due to the sudden death of the animals.

- To explain to the farmers the importance of insurance in livestock farming and make this scheme popular.

Guidelines:

The section of the livestock in agriculture is very much important on a national level. This is very special in terms of the economy in rural areas. The income which is generated by rearing the livestock is great supplementary support in terms of finance. If the farmer is facing any kind of problems in terms of production of crops or the farmers who do not have enough land can survive by rearing the livestock.

In order to promote the sector of livestock in the country, it would be better to provide better steps for the control of diseases and focus on how to improve the genetic qualities of the livestock. There should also be an implementation of the mechanism which guarantees protection to the livestock farmers and the people who rear the livestock by providing subsidy on the animals which had a sudden death. Thinking of this, the central government has approved a scheme that is sponsored centrally on the insurance for the livestock sector which was tested as a part of the tenth five-year plan. From the year 20018, this scheme is implemented on a regular basis in the 100 new districts selected until the completion of the eleventh five-year plan.

In case if you miss this: Dairy Farming Project Report For Bank Loan.

An agency which implements the scheme:

Fisheries, Dairy executive bodies and the Department of Animal husbandry are the executive bodies which are taking part in the implementation of the Scheme of National Project for Cattle and buffalo breeding. Their main objective is to upgrade the animals genetically by the process of artificial insemination and also by acquiring the animals which are already tested and proved. The National Project For Cattle and Buffalo breeding is being implemented by the implementing agencies on state level such as State Livestock Development Board. In order to bring interaction or cooperation between the NPCBB and the insurance for livestock, the livestock scheme is also being implemented by the State Implementing Agencies called as SIAs. The good thing is that most of the states opted for the NPCBB. The states which have not chosen NPCBB or the states which do not have State Implementation agencies, the livestock scheme is implemented with the help of the State Animals Husbandry Departments.

Executive Authority:

The Chief Executive Officer who is working for the State Livestock Development Board will be working as the executive authority for livestock scheme also. In the states which do not have State Livestock Development Boards, the director or the chief person of the Department of Animal Husbandry will be acting as the Executive Authority of the livestock scheme. The Chief Executive Officer will be working on the implementation of the scheme in various selected districts with the help of the officer who has a high experience and is working on a senior level in the Department of Animal Husbandry in the districts. The instructions for implementing the scheme will be passed on by the Government of the state. The Central Government provides funding for the premium subsidy, payment for the veterinarians, To create awareness in the districts with the help of panchayats. These will be done by the State Implementation Agencies with the help of funds provided by the Central Government. The Chief Executive Officers who are acting as the executive authority of the livestock scheme will have the complete responsibility of the execution of the scheme and they are the ones who need to monitor the scheme on various levels of execution.

Involvement of Veterinary practitioners:

The Veterinary Practitioners should play an active role in the village level to implement the livestock scheme successfully. They should work closely with the villagers to identify the animals which are fit for insurance by examining them. They can also play an active role in the determination of the present market price of the animals and tag the animals which are already insured. They can also help the government in the issue of veterinary certificates when the claim is done.

Veterinary practitioners can play an active role in the promotion of the scheme and making it popular on the village level. The veterinary practitioners who work for the state government will get involved in the scheme. If these are not available, then the private veterinary officers will be coming into the picture, But these private veterinary officers should be registered with the Veterinary Council of India.

Insurance policy cover commencement and the subsidy adjustment:

To get the trust of the farmers or the owners of the livestock on the scheme, the government makes sure that the policy cover will be issued as soon as the basic formalities are completed. The basic formalities include the identification of the animal, examination of the animals by the veterinary practitioner, assessing its market price and tagging the animal as an insured one along with half of the premium to the insurance agent by the owner. The insurance company which is selected will then agree to this contract. There is also a chance that the Insurance company will get the point from the insurance act saying that the insurance cover will be starting only after the entire premium amount is paid. So, to avoid such situations, the Chief executive officer will also be paying the remaining amount from the premium. The insurance company will now give few instructions to its branches that half of the premium amount is paid the livestock owner and the policy should be issued by adjusting the remaining half from the advance given by the CEO. The insurance company will also start preparing the statements on monthly basis regarding the issued policies and also indicating the value of each animal which has been assessed and the share of Government which has been signed by the district office of the Department of Animal Husbandry.

Read: Kadaknath Farming Guide, Loan, Subsidy, Contract Farming.

Animals covered under the scheme and the beneficiaries eligible:

The livestock which produces a high yield of milk which would be at least 2000 liters of milk for lactation are considered eligible under the scheme and they get the insurance depending on the market value. They can get insured to the maximum of 50% of their present market price.

If the animals are already having any sort of insurance, then they will not be considered eligible for this scheme. Only two animals can be selected for one beneficiary and one-time insurance is given for a time period of up to three years. The farmers will be asked to take the policy for three years so that it would be more helpful for him in economic terms and benefits him in times of natural calamities. But if the livestock owner prefers to go with the policy with a time span of fewer than three years for the reasons which are acceptable, then the farmer will be made available for the benefits of the subsidy. But there would be a restriction that the subsidy will not be available for the extension of the policy, therefore. The NCPBB will have the recorders to examine the field performance and these can be involved to identify the beneficiaries. The Gram Panchayats will also play an active role in helping the insurance companies to identify the beneficiaries.

Determining the animals market price:

Each animal can get insured to the maximum of its market price at present. The market price of the animals which is selected for the insurance policy will be determined by the veterinary practitioner along with the assistance of an insurance agent and the livestock owner who is selected as the beneficiary.

Identification of insured animal:

The animals which are been insured under the policy should be identified uniquely at the time of the claim. The foolproof for the animals which are insured is the ear tagging. Fixing the microchips is the recent method of setting a foolproof for the animals which are insured. The costs which occur for the ear tagging or setting the microchips will be taken care by the insurance company and the maintenance of these foolproof should be done by the beneficiary. The quality of the materials which are used for tagging the insured animals will be accepted by the beneficiaries and the insurance company. The Veterinary practitioners will play an important role in creating awareness among the livestock owners about the importance of maintaining the tags so that they can care proper care.

Change of owner during the validity period of insurance:

If the livestock owner has o sell the animal before the expiration of the Insurance policy, then the livestock owner has to make sure that the authority of the beneficiary should be transferred to the new owner. The mode of transfer, fees and the deed of the sale should be discussed and decided before the policy contract is signed with the insurance company.

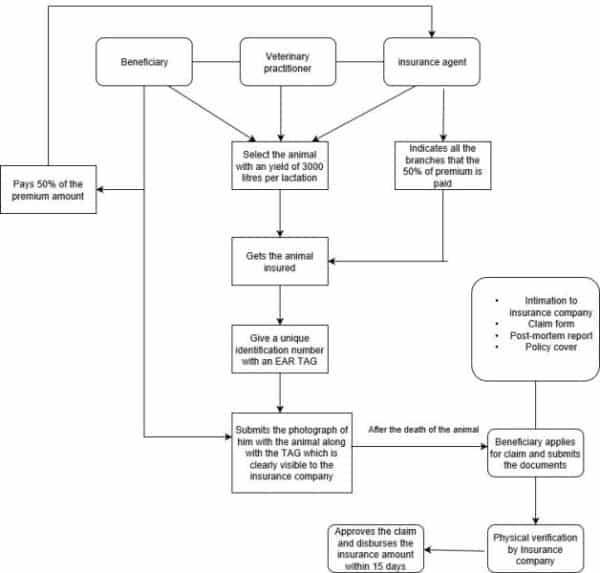

Entire Process of livestock insurance:

- An animal will be insured based on its market price in the present trend. The market price of pack animals such as the donkeys, horses, camels, male buffaloes and other animals in the livestock such as Goat, pigs, sheep etc are will be decided by the insurance agent, veterinary practitioner and the beneficiary collectively. The animal will be selected on the yield which is produced. The cow should give a yield of 2000 liters per day to get insured and the buffalo should give a yield of 3000 liters per day to get insured. If there is any conflict in deciding the price of the animal, then the gram panchayat will take part in the settlement of the price.

- The animal which is selected for the insurance should have a unique identity so that there would not be any conflicts at the time of claim. Ear tagging should be done and the beneficiary should be made aware of the importance of maintaining the ear tag by the veterinary practitioner.

- The tag which is placed will have a unique number for identification and an agreement will be made that there would be no conflicts at the time of conflicts between the beneficiary and the insurance company.

- While the process of the insurance is taking place, the beneficiary needs to submit one photograph of the animal with the beneficiary and the photograph should be taken in such a way that the ear tag of the animal is clearly visible.

- If the beneficiary is selling the animal to a new owner before the expiry date of insurance, then the authority of the beneficiary should be transferred to the new owner and he would be considered as the beneficiary of the insurance from now on.

- In order to settle the claims, there would be four documents necessary for the insurance company. They are the policy paper for insurance, claim form, intimation with the company and the postmortem report of the animal. If the claim is becoming due, the payment of the amount which is insured should be paid to the beneficiary within 15 days after the submission of the documents which are required.

Read: Pradhan Mantri Fasal Bima Yojana, Crop Insurance.

Livestock Insurance Claim Settlement:

The settlement of the claim will be simple to avoid any sort of difficulties at the time of claim. When the beneficiary is signing the contract with the insurance company, the procedure of the claim and the documents which are required at the time of claim should clearly be explained to the beneficiary. If the claim is becoming due, the amount which is insured must be paid to the beneficiary within 15 days after the beneficiary submits the documents which are required. When the insurance of the animals is being done, the executive authority should take care that the procedures of the settlement of the claims are clearly mentioned along with the documents of the policy. If the insurance company is not settling the claim within 15 days of submission of documents, then it has to pay a penalty of 12% of compound interest for a year to the beneficiary.

The process of Claiming the insurance:

- The beneficiary must inform the regional office about the loss of the animal. The verification of the coverage will be done by one of the branch offices and the registration of the claim will be done.

- The physical verification will be done by an insurance agent on a mandatory basis and the same will be conveyed to the branch.

- The branch office will work on the documentation of the claim and processes it for the approval of Chief Executive Officer.

- The Officer will check the documents considering the conditions of the policy and if the claim has to be paid, then the approval is given.

- If the claim is rejected, then the manager who is working on the claims should be signing it as a reject along with the reasons for rejection.

In case if you are interested in this: Organic Vegetable Farming Plan.

- How to Make Houseplants Bushy: Effective Tips and Ideas

- Innovative Strategies for Boosting Coconut Pollination and Yield

- Pollination Strategies for Maximum Pumpkin Yield

- The Complete Guide to Chicken Fattening: Strategies for Maximum Growth

- Natural Solutions for Tulip Problems: 100% Effective Remedies for Leaf and Bulb-Related Issues

- Revolutionizing Citrus Preservation: Towards a Healthier, Greener Future

- Natural Solutions for Peony Leaf and Flower Problems: 100% Effective Remedies

- Maximizing Profits with Avocado Contract Farming in India: A Comprehensive Guide

- Natural Solutions for Hydrangea Problems: 100% Effective Remedies for Leaf and Flowers

- The Ultimate Guide to Choosing the Perfect Foliage Friend: Bringing Life Indoors

- From Sunlight to Sustainability: 15 Ways to Use Solar Technology in Agriculture

- The Ultimate Guide to Dong Tao Chicken: Exploring from History to Raising

- The Eco-Friendly Makeover: How to Convert Your Unused Swimming Pool into a Fish Pond

- Mastering the Art of Delaware Chicken Farming: Essentials for Healthy Backyard Flocks

- 20 Best Homemade Fertilizers for Money Plant: DIY Recipes and Application Methods

- How to Craft a Comprehensive Free-Range Chicken Farming Business Plan

- Brighten Your Flock: Raising Easter Egger Chickens for Beauty and Bounty

- How to Optimize Your Poultry Egg Farm Business Plan with These Strategies

- Subsidy for Spirulina Cultivation: How Indian Government Schemes Encouraging Spirulina Farmers

- Ultimate Guide to Raising Dominique Chickens: Breeding, Feeding, Egg-Production, and Care

- Mastering the Art of Raising Jersey Giant Chickens: Care, Feeding, and More