The global economy is set to slow down this year. 2022 was a year in which economies had a chance to rebound from the COVID-19 pandemic—a year in which most countries, except China, had stopped lockdowns. However, the resurgence of productivity was met with continued supply chain issues, along with a war in Europe that has had radical implications for the energy market.

As a result, inflation soared and is set to continue being above target levels throughout most of the world. For India, retail inflation is expected to decline to 5%. Whilst this is technically within the RBI’s comfort zone, it’s far higher than the target inflation rate of most central banks. Plus, not all inflation is created equally, and the current inflation is created by supply shocks as opposed to insatiable demand.

2023 is expected to see the global economy slow down even more, with many countries entering a technical recession. However, it is true that some of India’s inflation is driven by growth because 2022 saw 6.8% growth. This is expected to fall to 6.1% in 2023. One driver of this slowdown, and underperforming the previous projections of 7%, is that the global slowdown will hurt exports. Jewelry and electronic goods could suffer, although petroleum products may benefit from the ongoing energy crisis.

However, another huge factor in the anticipated slowdown is due to interest rates. Whilst the Asia-Pacific region is not likely to see a recession, interest rates have risen and have caused debt-driven investment to become more expensive, all whilst saving is more appealing. Steve Cochrane, the chief APAC Economist of Moody’s Analytics, says, “That said, a recession is not expected in the APAC region in the coming year, although the area will face headwinds from higher interest rates and slower global trade growth.”

Cochrane also goes on to say, “China is not the only weak link in the global economy. The other giant of Asia, India, also suffered a year-to-year decline in the value of exports in October. At least India relies less on exports as an engine of growth than does China.” When comparing the prospects of India to China, the US, and the EU, it appears India is seizing an opportunity to emerge as a “bright light”, as IMF chief economist Pierre-Olivier put it. And how the economy impacts agricultural business is far-reaching.

The Impact of a Global Slowdown on Agriculture

Traditional businesses like agriculture often hold up strongly in difficult times. This is mostly because they are inelastic goods in that they are non-luxury and non-inferior. Necessary goods are the ones that we need to stay alive, goods that cover our basic needs of heat, sleep, and energy.

Wheat

In 2023, India is expected to see a boost in its wheat crop. This is driven by two factors. Firstly, replenished soil moisture has helped with yields, but secondly, high domestic prices. In this instance, inflation is not harming Indian agriculture. However, India has had a ban on wheat exports since May last year—a decision that was criticized overseas. German Food and Agriculture Minister Cem Ozdemir claimed, “If everyone starts to impose export restrictions, that would worsen the crisis.”

In case you missed it: Digital Agriculture in India: Challenges and Opportunities

The crisis that Ozdemir was referring to was the grain production issues caused by the Russian invasion of Ukraine. Russia is the number one exporter of Wheat, whilst Ukraine is the second. However, Russia has been the subject of relentless sanctioning from the West over its decision to go to war with Ukraine, which inevitably impacted wheat exports. And, of course, wheat exports were set to reduce from the Ukrainians too.

Because of this, Wheat prices have risen substantially, and India could take advantage of this. However, their decision to ban exports was because they saw very high temperatures that affect wheat crops, which caused their own concern over production. The higher wheat output could result in lifting the ban because it may help ease high retail inflation along with benefiting from exporting a scarcer-than-usual product. Domestic prices jumped up 33% in 2022 due to the poor yields last year.

GDP and Technology within Agriculture

Despite the hot temperatures and wheat export ban, the first quarter of Agricultural GDP in January 2022 was 6626 INR Billion, up from 6462 INR Billion in 2021 and 6208 INR Billion in 2020. This upward growth has been consistent since 2016 and will likely continue next year. India has always been an agrarian economy. Its vast landmass lends itself well to growing crops and tropical climates. However, more focus needs to be placed on developing technology within agriculture.

In case you missed it: High-Tech Farming in India: Policy Framework for Revolutionizing Indian Agriculture

Deloitte argues that this should come from government policy interventions to help support and promote tech innovation within the industry. There has already been a 2021-2025 governmental project named Digital Agricultural Mission, which aims to connect technology developers with farmers to come up with solutions to improve efficiency. Furthermore, mobile applications are planned to help farmers get better information on things like the weather and market prices.

The Russo-Ukrainian Butterfly Effect

The decision made by Vladimir Putin to invade Ukraine has had huge implications around the world. Whilst initially it appears to be a military conflict alone, the agriculture of both countries has been disturbed, the imports and exports from both countries have slowed dramatically, and many global markets, as a result, have lost equilibrium.

Compared to projections before the war, the global outlook is worse according to the OECD, with around 2.2% global growth expected in 2023 and, again, a sub-par 2.7% in 2024. China, Indonesia, India, and Saudi Arabia are expected to be some of the best performers, whilst Russia, Ukraine, and the UK will be some of the worst performers. In fact, most of Europe will struggle to see any growth because these are the countries most directly impacted by the war.

It’s not just wheat and energy markets that have had a supply shock, but sunflower seeds too. Many of these raw materials and ingredients are used in other products, which is pushing the price up, as well as the higher transportation and production costs from the energy crisis. Things could get worse, of course, from further escalation. But the other implication could be positive, in that Europe’s push away from Russian oil and gas may mean green initiatives are accelerated.

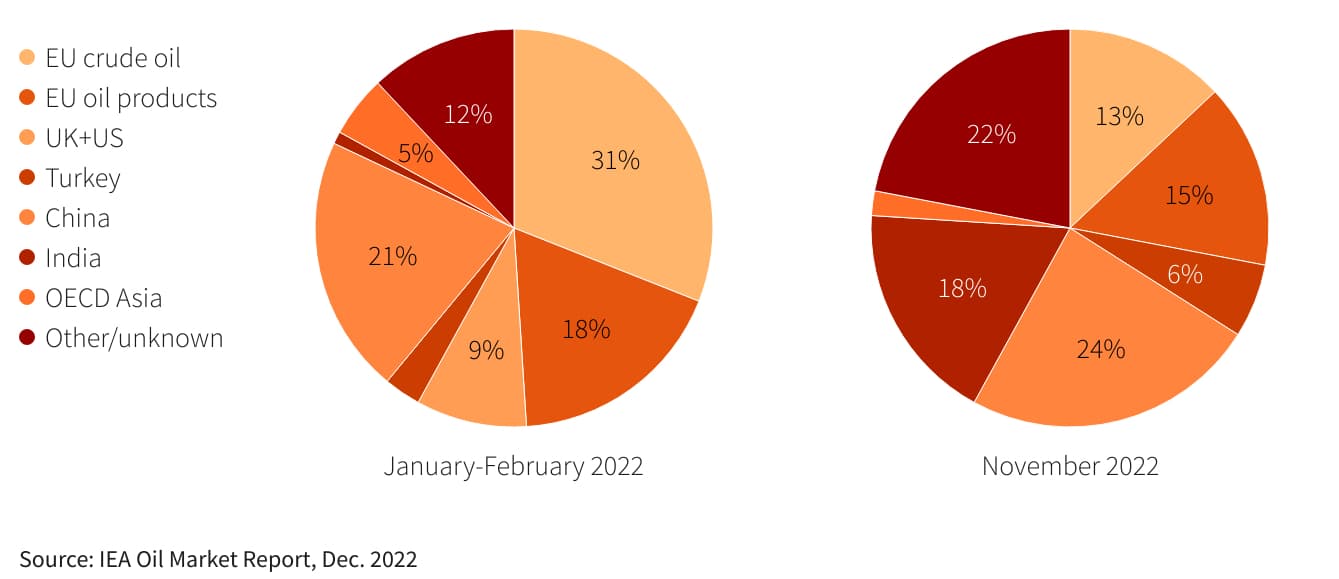

Russia Oil Exports by Destination

The Reuters chart shows that the US and Europe have dramatically reduced oil imports from Russia. The stats are very similar for gas, too, as 50% of the EU’s gas was from Russia, but is around 12.9% as of November 2022.

How Rate Increases Impact Farm Finance

Beyond climate, technology, and energy, there are other influences on agriculture’s 2023 predictions. It’s not just the US and Europe that have had to increase interest rates to combat the inflation, of course, as the Reserve Bank of India increased rates from 4% to 6.25% in 2022. And higher borrowing costs have serious implications on agricultural business financing.

Lots of farms are heavily leveraged, in part because land and machinery are core to the operation. It is common for farmers to see expensive vehicles breakdown, and replacements can be difficult to make with cash, which is why the Kisan Credit Card (KCC) offered by banks to farmers is useful. Farms and other agricultural businesses’ lending is vital for the business. In 2022, the lending for the KCC card was 7%, with an interest subvention rate of 2%.

In case you missed it: Cooperatives in Agriculture: Empowering Farmers and Strengthening Local Economies

Rising rates in 2023 could become an issue for farmers, as higher repayments are a threat to cash flow. This problem is made worse if there are similarly high temperatures as last year, to which the farmers with higher leverage will take on the biggest risk. Whilst not all farmers have a KCC, the number of farmers that do is now in the millions as the government has stepped up efforts in recent years.

It’s not just the higher borrowing costs that are a threat but also a possible reduction in investment. As seen in the West, a sharp increase in interest rates without knowledge of whether they will continue can seriously hinder outside investment and internal investment from the farmers themselves. A cooling of investment within agriculture could have implications for the industry’s digitalization efforts.

Agriculture 2023 Projections and Beyond

USDA’s World Agricultural Supply and Demand Estimates (WASDE) report weighs in on the current trend of global agricultural markets over the next year and a half. The report suggests that the current market is shaped by COVID-19 disruptions, extreme weather events, and international economic concerns. It also states that meat demand is upheld in the face of declining cattle numbers, which are caused by higher production costs and droughts.

In case you missed it: Integrated Organic Farming: A Holistic Approach to Agriculture

However, poultry and pork growth are doing well, and production is set to slightly increase, meaning livestock prices are set to fall in 2023. For India, specifically, strong governmental efforts in digitizing agriculture are expected to reduce the impact of the climate and economic headwinds. These might include investments in AI models, remote sensing, earth observations, and cloud computing.

However, private investments in technology may suffer from higher borrowing costs, along with agricultural business funding more generally, meaning government initiatives will play a key role. Furthermore, the global energy crisis may also have ramifications on India’s approach to sustainability. Despite their increasing business with Russia for energy, this is clearly a volatile and potentially short-term solution to what could be an imminent catastrophic Russian decline.

It’s seldom wise to have more eggs in the basket of a country that is central to volatile geopolitics, particularly when there are more enemies than allies, and this could result in India stepping up investment efforts within sustainability projects. Agriculture becomes a focal point for such projects because of the energy that it consumes. The United Nations has recently urged there to be more help for poorer nations to help them withstand global warming.

While this has been tepid so far, efforts are expected to increase in 2023, which could benefit India’s farming. Finally, there is expected to be a stronger global focus on maximizing the transparency of international food systems. This means stronger collaboration in data science, AI models, weather data, drones, and IoT to help result in more visibility over the agricultural production lifecycle.

It is estimated that 500 million of the 580 million global farmers are small-holder farms. The same holds true in India, and thus such efforts on digitization and visibility will likely see working-class, smaller farms benefit. Yields will still depend on the weather, but better data and technology could help reduce the damage they cause compared to previous years.

In case you missed it: How to Control Pests and Diseases in Strawberry Crop: Causes, Symptoms, Chemical, and Biological Management

As for the longer vision, Omnivore VC, a venture capital firm that invests in the agricultural sector, lays out the path clearly. Of the 130 million Indian farmers, farming must become profitable, produce must become more nutritional (not just calories), and the environmental impacts must be reduced.

- Modern Sheep Farming Technology: The Future of Sheep Husbandry

- Goat Farming Technology: The Future of Goat Husbandry

- How to Build a Low-budget Goat Shed: Cheap Ideas and Tips

- Goat Farming Training Programs in India: A Beginner’s Guide

- Types of Pesticides Used in Agriculture: A Beginner’s Guide

- Economical Aquaculture: A Guide to Low-Budget Fish Farming

- 15 Common Planting Errors That Can Doom Your Fruit Trees

- How to Make Houseplants Bushy: Effective Tips and Ideas

- Innovative Strategies for Boosting Coconut Pollination and Yield

- Pollination Strategies for Maximum Pumpkin Yield

- The Complete Guide to Chicken Fattening: Strategies for Maximum Growth

- Natural Solutions for Tulip Problems: 100% Effective Remedies for Leaf and Bulb-Related Issues

- Revolutionizing Citrus Preservation: Towards a Healthier, Greener Future

- Natural Solutions for Peony Leaf and Flower Problems: 100% Effective Remedies

- Maximizing Profits with Avocado Contract Farming in India: A Comprehensive Guide

- Natural Solutions for Hydrangea Problems: 100% Effective Remedies for Leaf and Flowers

- The Ultimate Guide to Choosing the Perfect Foliage Friend: Bringing Life Indoors

- From Sunlight to Sustainability: 15 Ways to Use Solar Technology in Agriculture

- The Ultimate Guide to Dong Tao Chicken: Exploring from History to Raising

- The Eco-Friendly Makeover: How to Convert Your Unused Swimming Pool into a Fish Pond

- Mastering the Art of Delaware Chicken Farming: Essentials for Healthy Backyard Flocks

- 20 Best Homemade Fertilizers for Money Plant: DIY Recipes and Application Methods

- How to Craft a Comprehensive Free-Range Chicken Farming Business Plan

- Brighten Your Flock: Raising Easter Egger Chickens for Beauty and Bounty

- How to Optimize Your Poultry Egg Farm Business Plan with These Strategies

- Subsidy for Spirulina Cultivation: How Indian Government Schemes Encouraging Spirulina Farmers

- Ultimate Guide to Raising Dominique Chickens: Breeding, Feeding, Egg-Production, and Care

- Mastering the Art of Raising Jersey Giant Chickens: Care, Feeding, and More

- Ultimate Guide to Raising Legbar Chickens: Breeding, Farming Practices, Diet, Egg-Production

- How to Raise Welsummer Chickens: A Comprehensive Guide for Beginners

- How to Protect Indoor Plants in Winter: A Comprehensive Guide

- Ultimate Guide to Grow Bag Gardening: Tips, Tricks, and Planting Ideas for Urban Gardeners

- Guide to Lotus Cultivation: How to Propagate, Plant, Grow, Care, Cost, and Profit

- Agriculture Drone Subsidy Scheme: Government Kisan Subsidy, License, and How to Apply Online

- Ultimate Guide to Raising Araucana Chickens: Breed Profile, Farming Economics, Diet, and Care

- Bringing Hydroponics to Classroom: Importance, Benefits of Learning for School Students