Rice mill subsidy and loan schemes in India: Rice is the staple food and an important item in the daily basis. There are various genetic diversities and varieties of rice where you can find numerous across the globe and two third of the world population survives with the consumption of either rice or its various related produces. Rice milling is the major requirement after the attaining the plant product which mainly involves removal of hulls and brans from paddy grains. This main output is main resource which is produced after removing the husk of the paddy grains in the form of polished rice which is regularly seen in the market and is usedin the consumption.

A guide to rice mill subsidy and loan schemes in India

As this is an important thing, hence government is encouraging to establish rice mills to meet the demand in rice production by providing various loans, schemes and subsidies. Loans are provided for existing or to establish new rice millers by State Bank of India under the SBI Rice Mill Plus loan scheme. The Indian economy is providing various schemes and loans in order to support the farmers especially in financing food processing units through different schemes like the FPTUFS scheme. In this specialized scheme, highest priority is given for supporting financing of rice mills in India. In this aspect, State Bank of India is playing a crucial role in the overall growth and development of the SME sector. SBI also offers a wide range of products and services for the needs of the SME sector.

SBI provides loans to the rice mills having a credit ranging from SB-9 (State Bank of India’s rating scale) or above are eligible for the Rice Mill plus scheme. Funding is provided under the SBI Rice Mill plus scheme, which can be used to develop the business for acquisition of machinery, factory building or expansion of existing premises or for modernization. You can use the funds which can also be used for working capital purposes.

Manufacturing rice from rice mill

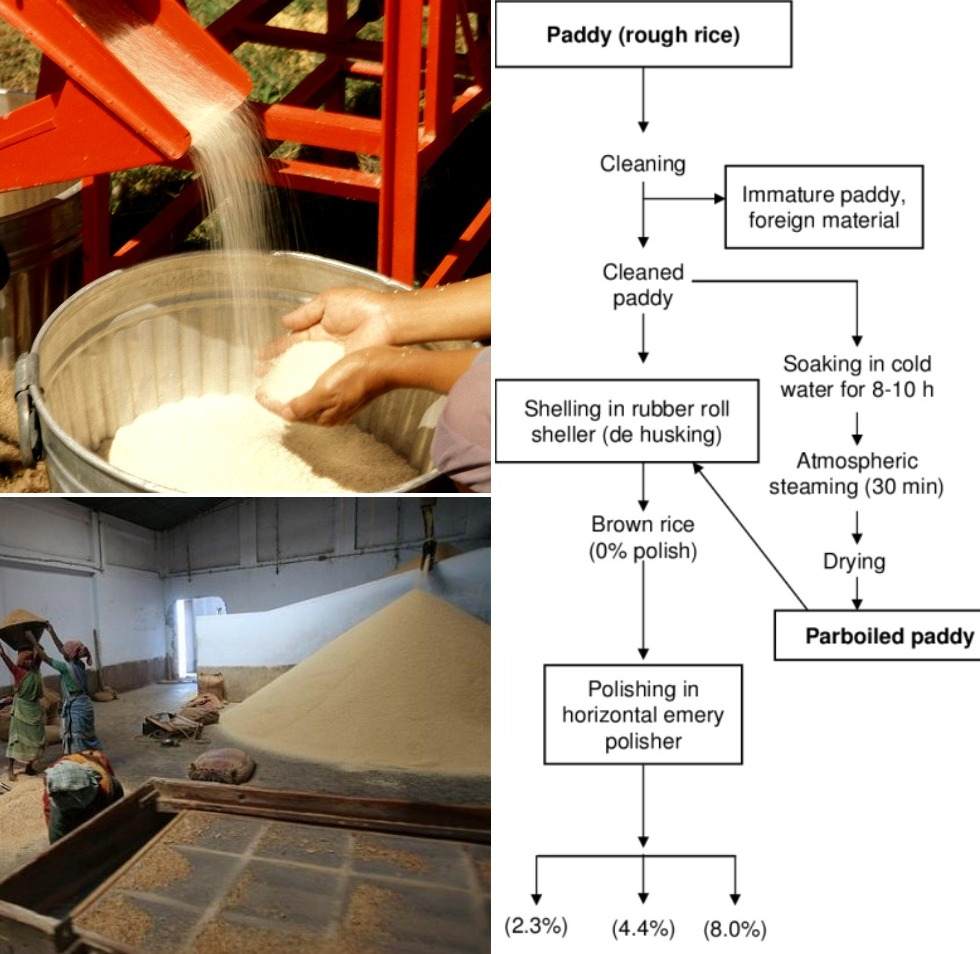

The process of manufacturing the rice from rice mill involves the following processes. These include the following steps-

- First process involves cleaning of paddy

- Next cleaning of the raw paddy in the tanks

- Soaking of the paddy in the tanks

- Draining of the water from the paddy

- Steaming in the vessel above 95°C

- Then these paddy grains should be send to the rice mill

- Tempering for 24 hours in day bins in the rice mill

- Drying the tempered paddy at 100°C or 70°C for about 6 hours

- Next unload the heat dried rice from the drier

You should not miss the Cold Pressed Oil Project Report, Subsidy, Loans.

Technologies required in setting up the rice mill

These technologies include the following operations. These are of following namely de-stoner, paddy husker and paddy separator, vertical whitener, humidifier, air polisher, grain colour sorter, pre-cleaner, airlocks, various motors and gears, elevators, filters, sifters, graders, and blowers, electronic weighing and machines, bagging systems and salt conveyer, rotatory screw air compressor, DG set, weigh bridge, electrical infrastructure and other control accessories etc.

Loans and subsidies available to establish rice mill

There are many loan and subsidies available, let us see the eligibility criteria, amount of subsidy or loan sanctioned, interest and repayment periods etc.

The eligibility criteria to get the loan or subsidies

The eligibility criteria for the Rice Mill plus scheme or the loan to be sanctioned, the unit need to maintain the activity of rice milling and also need to show the profitability. A 15% to 25% of margin amount of money is required to apply for term loan and a 15% to 40% margin money is necessary is required is apply for working capital facility. Newly established rice mills are also eligible to avail this as a financing under this scheme.

Amount of loan sanctioned

Loan amount can be sanctioned for a working capital (fund based or non-fund based) or term loan. The amount of loan would depend on the capability of the applicant, project cost and the requirement based on the working capital requirement of the business. There is no extra percentage of the amount of loan or subsidy that can be sanctioned under this scheme for establishing or developing a rice mill.

Interest and repayment methods

There are different interest rates in rice mill plus loan which is sanctioned with a floating interest rate, liked to the base rate. This interest rate would be determined based on the size of limit of rice mill, the value of collateral security provided or deposited to the bank and also the borrower risk profile.

Term loan sanctioned under this scheme will have a repayment period which lies in between 5 to 7 years excluding moratorium period which will be of 12 months. Working capital facility would have a 12 month period for repayment and is also subjected to the renewal based on the satisfactory conduct of the account.

Collateral security required to submit

If you apply for a loan amount of less than Rs.10 lakhs, then it can be sanctioned under the CGTMSE scheme without any requirement of collateral security. If the loan amount over Rs.10 lakhs, then it must be secured by submitting an equitable mortgage of property or tangible security belonging to the borrower or guarantor.

In addition to the collateral security, the bank would extend the pledge over assets created out of bank’s finance and as per rules and regulations. All assets created using bank loan and subsidies availed must also be insured to the full value of the business.

You may also like the Flour Mill Project Report, Cost, Subsidy, Loan.

Banks that provide loans for rice mill establishment

The below are the list of the banks which provide the loans for rice mill establishment. These are listed as below

- State Bank of India-SBI

- Canara Bank

- Punjab National Bank-PNB

- Andhra Bank

- Central Bank of India

- Bank of Baroda

- State Bank of Bikaner & Jaipur

- UCO Bank

- Bank of India

- SIDBI

- North Eastern Development Finance Corporation-NEDFi

Subsidies available for rice mill

The subsidies available for getting the amount is 25% for the amount below Rs.50 lakhs and 33.33% for the amount above Rs. 50 to 75 lakhs. This can be availed based on the eligibility of the person who applied for the subsidy.

Licensing and permission for rice mill establishment

The Rice Mills requires the following licenses. Any person or authority may apply for permission to apply through a application to the Central Government of India for the granting of a permit. These include-

- No Objection Certificate from district collector.

- Permission from the concerned local body of municipality.

- Permission from the local power station for a minimum of 100Kv power supply.

- Permission from town planning or city planning commission based on the locality you are planning to establish the rice mill.

Documents required for availing this loan or scheme or subsidy

The below are the documents required for availing the loan are listed below-

- A detailed project report of the rice mill.

- The business plan of the rice mill

- Land documents where you are willing to establish the rice mill.

- The details of the cash flows for about the one year.

- The credit appraiser of the business idea which is well planned.

- A detailed project report of the rice mill to obtain a collateral-free loan in India.

- Costs involved for establishing the project, machinery cost etc.

- Registration document of the rice mill.

- Address proof of the rice mill established.

- GST registered document of the business.

- Proof of the SC, ST or Minority or Tribe of the applicant if he/she belongs to that category.

- Details of the annual income of the family with brief details of the sources.

- Attest the ration card number and the Xerox copy of it.

- Documents of the fixed assets, current assets and the list of total assets.

- Location of the market for the products and the financial projections.

- You need to attest the means of financing example promoters contribution, subsidy, seed capital, loan, etc.

- Two passport sized photographs.

- Balance sheets of monthly turnover for last twelve months.

- Arrears of the statutory payments such as income tax, sales tax, provident fund, employees state Insurance Corporation and others if any specify.

- List the manufacturing process, in brief and indicate to the extent possible, stage-wise capacity data, yield/ conversion data, material flow, etc.

- Enclose certified xerox copy of sanctioned from the authorized power connection, water connection, fuel connection and other if any etc.

- Specify whether the product is assessed under SSI.

- Details of the securities to be offered and submitted.

- Certificate for commencement of rice mill business.

- Sales tax returns for the last three years of the established rice mill.

CGTMSE scheme details

The CGTMSE Scheme is designed to support the small scale entrepreneurs, SME industries and medium-sized enterprises where you can obtain a loan of about Rs.1 crore without any collateral loan in India. Many of the banks in India are actively providing collateral-free loans under the CGTMSE Scheme in India to encourage the entrepreneurs in small and medium scale levels. The applicant can avail the total benefits of the scheme by submitting proper applications in the correct format within the framework of the project plans. Every individual can avail this loan based on the qualification and type of the project which you are going to establish.

The above information may be applied to rice mill subsidy and loan in Karnataka, rice mill subsidy and loan in Tamilnadu, rice mill subsidy and loan in Telangana, rice mill subsidy and loan in Maharashtra, rice mill subsidy and loan in Andhra Pradesh, rice mill subsidy and loan in Kerala, rice mill subsidy and loan in Bihar, rice mill subsidy and loan in Madhya Pradesh, rice mill subsidy and loan in Uttar Pradesh, rice mill subsidy and loan in West Bengal, rice mill subsidy and loan in Gujarat, rice mill subsidy and loan in Rajasthan, rice mill subsidy and loan in Punjab, rice mill subsidy and loan in Haryana, rice mill subsidy and loan in Uttarakhand, rice mill subsidy and loan in Chhattisgarh, rice mill subsidy and loan in Odisha, rice mill subsidy and loan in Assam, rice mill subsidy and loan in Himachal Pradesh, rice mill subsidy and loan in Nagaland, rice mill subsidy and loan in Meghalaya, rice mill subsidy and loan in Tripura. You might be interestd in How to Grow Egg Plant in Aquaponics.

Agrifarming this website is very useful & helpful to the Farming community.

Thanks Hearty Thanks &Congratulations to this website….

M.Duraipandi A Farmer…

I’ve new user agrifarming ,but it’s messages are very useful for every farmer.thank so much.

I am Santos mallick as profesanaly S/E come from agricultural family. I want startup Rice Mill. I have 2 acre road side land, exilent road communication. This place is hube of paddy production. For startup I need 10crore loan through MSME. How & where I getting the loane any body kindly guide me.

Hello Jagdish Reddy,

The content is very useful and it is descriptive. It covers all ascpects of Rice Mill establishment.

This content is of Feb 2020 and currently Government is offering new schemes so would like to contact you for those.

Regards,

Amit

We are interested in rice mill industry, please send terms and conditions

Sir I would like to apply for the loan to establish a Rice mill.

Mujhe rice Mil ke liye loan chahie

i am intrested in rice prosesing mill

Can you mention at which scheme government is providing 25% subsidy for setting up of new rice mill.

I want subsidy of 3 ton par boiled ,rice mill under cgtmse. Scheme, send me details

I Want subsidiary 3 ton capacity modern parboiled under Small scale industries please send me details

i want to start up dealership for agriculture machinery equipment’s like combined mill ,thriller in small scale investment upto 10 lakhs is it requirement for obtaining license from concerned department, or not ? Is any financial help getting from banks or not ? your suggestion awaited.

I want to set a new RICE MILL at DEWANMARO MOUZA land 129 decimals. Kharagpur , PASCHIM MEDINIPUR ,WEST BENGAL. PLEASE advise.Thanks and Regards.

I am interested a rice mill prosesing project in odisha,jajpur,dharmasala eria

I need scheme for rice mill

I need a partner/ investor for my new rice mill startup

I want to start a Rice Mill Industry in Odisha, please guide me.

I need loan for rice mill

I needed rice mill 1crore loan details

I want start new rice mill i have recently purchase the 2 acre land on road i want to how much subsidy i will get on rice mill in haryana and the process of subsidy.

Mujhe rice mil lagana hai please guide Karen